Prepare for the 2025 IRS: Essential Tips to Maximize Your Refund

As the period for submitting the IRS declaration for 2024 income approaches, it is crucial to be well-informed to ensure you receive the maximum possible refund or pay the minimum tax required. The submission period runs from April 1 to June 30, 2025.

Retirement Savings Plan (PPR): What You Need to Know to Ensure a Secure Financial Future

If you are thinking about your financial future and retirement, it is important to consider strategies that will help you accumulate savings efficiently. In Portugal, the Retirement Savings Plan (PPR) is a popular tool for this purpose, offering a combination of tax benefits and a structured way to save in the long term. In this article, we will explore what a PPR is, how it works, the tax benefits it offers, and why it can be an excellent choice for your retirement.

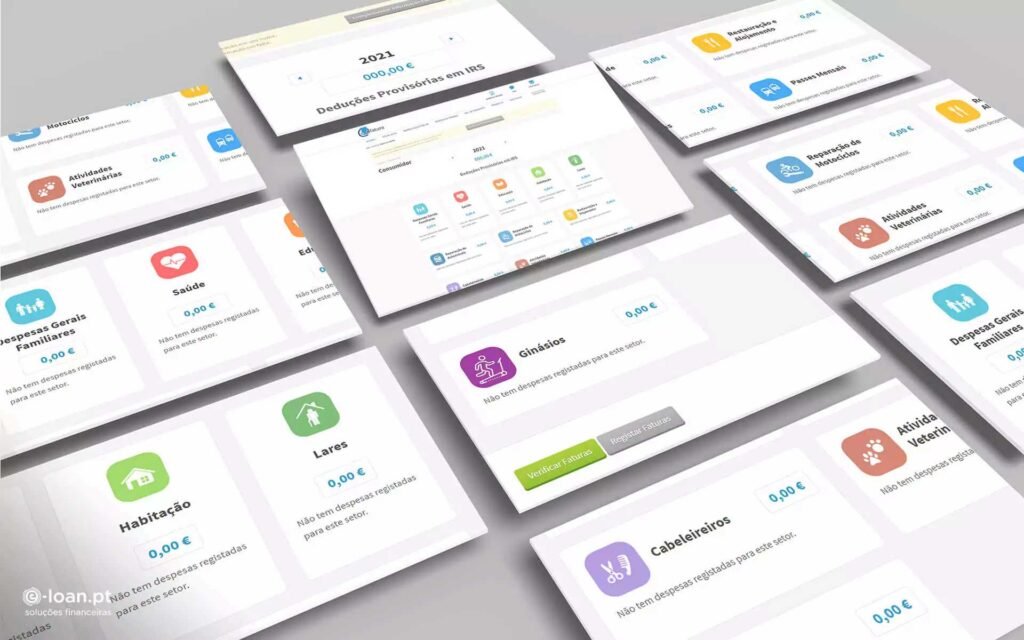

Complete Guide to Deductible Expenses in IRS in Portugal

In the process of filling out the Income Tax return, one of the most important aspects is the deduction of expenses, which allows taxpayers to reduce the amount of tax to be paid. In this guide, we explore the main categories of deductible expenses and their applicable percentages and maximum limits.

Tax Support for Young People: Discover How to Save on IRS Up to 35 Years Old

Young people up to 35 years of age have access to important tax benefits that help them save on Personal Income Tax (IRPF). These measures are part of public policies that aim to facilitate the transition to adulthood, promote financial independence and encourage young people to settle in Portugal. If you are under 35, it is essential to know about these opportunities to optimize your financial management.

NHR 2.0: A New Tax Incentive for Startup and Research Professionals

Portugal has emerged as an attractive destination for international talent and skilled workers, especially in sectors such as technology, research and innovation. In 2024, the country introduced NHR 2.0, an evolution of the Non-Habitual Resident (NHR) tax regime, with new conditions and incentives aimed at professionals from startups and research entities.

Advantages of Establishing Yourself as a Self-Employed Worker in Portugal

Establishing yourself as a self-employed worker in Portugal can be an advantageous choice for many professionals, especially in a constantly evolving job market. This regime allows for greater flexibility, freedom and, in many cases, greater earning potential. Furthermore, the associated tax framework offers options that can be adjusted to the needs and reality of each worker.

The Simplified IRS Regime in Portugal: What is it and How Does it Work?

The Simplified IRS Regime is a tax framework for self-employed workers in Portugal, designed to simplify the calculation of tax for professionals who carry out activities on their own account. This regime offers several advantages, including specific benefits for those who are starting to work, such as Social Security exemptions and significant discounts on IRS taxable income in the first two years.

IFICI Practical Guide: Tax Incentive Regime for Scientific Research and Innovation

The Tax Incentive Regime for Scientific Research and Innovation (IFICI) was created by the Portuguese Government with the aim of attracting qualified professionals to the country, encouraging research, development and innovation activities in strategic sectors of the national economy.

The Organized Accounting Regime in Portugal: Everything You Need to Know

The Organized Accounting Regime is a tax option available to self-employed workers and companies in Portugal who want greater personalization in managing their finances. This regime is mandatory for those who exceed certain income limits, but it can also be a strategic choice for professionals or businesses with high and specific expenses.

FA ACCOUNTING establishes partnership with Revolut Business

FA ACCOUNTING is pleased to announce its latest partnership with Revolut Business, launched in February 2025. This collaboration aims to provide our clients with more agile, efficient, and innovative financial solutions, tailored to the needs of the digital world.