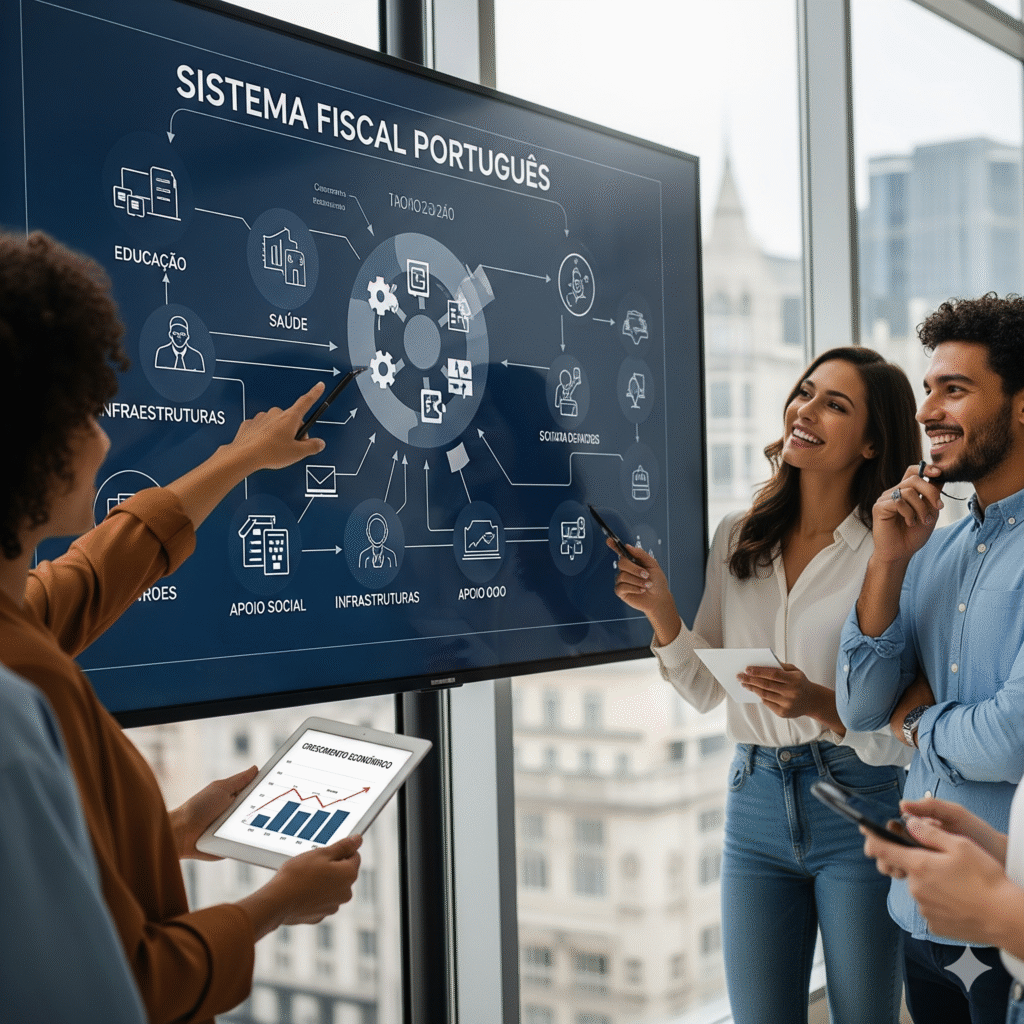

A modern, fair, and transparent tax system can be a powerful driver of economic growth and social cohesion. However, in Portugal, its high complexity and constant legislative changes are hindering this potential.

🔍 Key Problems

- Complexity and legal uncertainty

- The tax infrastructure is full of codes, exceptions, and special regimes, resulting in a confusing environment for taxpayers, accountants, and businesses.

- Frequent legislative changes, often without impact assessments or dialogue with those affected, intensify the uncertainty.

- Heavy bureaucracy

- Small and medium-sized enterprises (SMEs), the main drivers of the economy, face costly administrative steps that divert resources from innovation, expansion, or hiring.

- Accountants end up focused on complying with obligations rather than generating strategic value for clients.

- Disincentives to investment

- Fiscal confusion and uncertainty deter investors—both domestic and foreign—reducing the potential for economic growth and employment.

- Socially, the perception of injustice undermines confidence in institutions.

✅ Necessary Reform: Towards a More Efficient System

For the Portuguese tax system to become a catalyst for development, structural changes are urgently needed:

- Simplification and clarity

- Reduce the web of special regimes and ancillary obligations. Adopt clear and more transparent legislative language.

- Institutionalized dialogue

- Create regular channels for consultation between the Government, the Tax Authority (AT), accountants, and businesses, ensuring time for adaptation to new rules.

- Education and fiscal literacy

- Invest in fiscal literacy programs from an early age so that citizens understand the social role of taxes and feel part of the system.

- Structural reform, not patchwork

- Instead of punctual adjustments, move forward with a deep reform based on fiscal rationalization, digital modernization, and bureaucracy reduction.

🎯 Opportunities to Seize

- Greater competitiveness: A simpler system attracts investment, boosting the economy and creating jobs.

- Greater public trust: When taxpayers perceive fairness and clarity, confidence in the state grows.

- More balanced State–Citizen relationship: Less intrusive inspection, more proximity, and cooperation.

📣 Conclusion

The tax system can and should be a tool for development—but only if it is efficient, transparent, and inclusive. The current complexity limits the country’s economic and social potential. A structural reform based on simplification, dialogue, and fiscal education is essential to transform taxes into a lever for growth.

At FA Accounting, we follow fiscal transformations and support companies in adapting to new regimes. If you wish to better understand these proposals or prepare your organization for future challenges, talk to us.

Did you like this article? Share it with friends and family so everyone can benefit from this regime in Portugal!